The container shipping industry is preparing for a substantial realignment in 2025, as major carriers unveil new strategic partnerships and service networks. At the heart of these changes is the dissolution of long-standing alliances, such as the 2M partnership, and the formation of new collaborations that will reshape global shipping routes and operations.

These shifts, effective from 1st February 2025, reflect a strategic move by carriers toward more flexible partnerships which will ensure they remain well-positioned to meet their evolving strategic priorities.

As market conditions evolve, carriers are reassessing their alliance strategies to better align with long-term strategic goals. Shipping alliances have traditionally helped increase efficiency and pool resources, but recent shifts reflect a focus on optimising operations and meeting strategic objectives.

The End of the 2M Alliance and New Collaborations

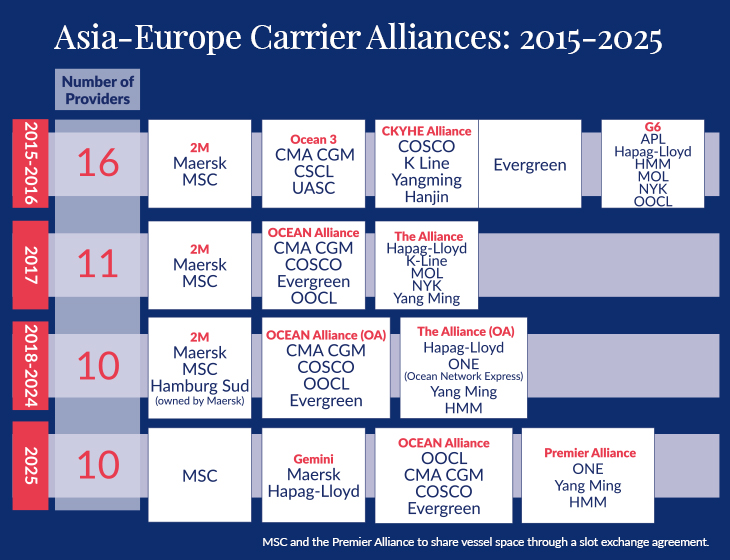

One of the most notable changes is the end of the 2M Alliance, which for years was a cornerstone of global shipping between Maersk and MSC. As of February 2025, MSC will operate independently on East-West trade lanes, while Maersk will team up with Hapag-Lloyd in a newly formed partnership called the Gemini Cooperation. This new alliance is expected to provide enhanced service offerings across critical east-west lanes, combining Maersk’s vast network with Hapag-Lloyd’s operational expertise.

Meanwhile, the remaining members of THE Alliance – ONE, HMM, and Yang Ming – will rebrand as the Premier Alliance. Notably, the Premier Alliance will enter a slot-sharing agreement with MSC on the Asia-Europe trade, marking a significant shift in how these major carriers collaborate and compete. This new cooperative agreement will enable the Premier Alliance and MSC to optimise capacity and enhance service reliability on one of the most important global trade routes. According to schedules published by the Premier Alliance and MSC, this cooperation will cover nine Asia-Europe services, however, both carriers will maintain some autonomy, with MSC operating its Asia-North Europe services independently.

In a parallel development, MSC has also signed a three-year vessel service agreement with ZIM, covering the transpacific trade. This agreement will allow MSC to expand its service offerings on the Asia-North America east coast route, further solidifying its position as the leading carrier in global container shipping. ZIM, an Israeli carrier, expressed its enthusiasm for the partnership, which marks a significant move in its efforts to enhance its presence in the transpacific market.

These strategic partnerships represent a broader trend in the industry, where carriers are increasingly turning to cooperative agreements to maximise their operational efficiency and address challenges in capacity utilisation. By working together, MSC, ZIM, and the Premier Alliance hope to offer more comprehensive, reliable services, while also responding to the evolving demands of global trade.

Sustainability and New Regulations Drive Change

While the restructuring of alliances is driven by market forces, it is also heavily influenced by the growing emphasis on sustainability. In 2025, the International Maritime Organization (IMO) will implement new regulations aimed at reducing greenhouse gas emissions, including stricter fuel standards and GHG pricing mechanisms. These regulations will place additional pressure on carriers to adopt more sustainable practices, pushing them to invest in eco-friendly technologies and cleaner fuel options.

For stakeholders across the logistics and trade sectors, the integration of sustainability into these new alliances will be crucial. Carriers will need to balance the costs of complying with environmental regulations while maintaining competitive pricing and reliable services. Green shipping corridors, which prioritise low-emission routes, are expected to play a key role in shaping the future of container shipping.

Impact Service Reliability and Competition

The disbanding of the 2M Alliance and the formation of new partnerships like Gemini and Premier are expected to significantly impact service reliability and competition within the container shipping industry. For example, Gemini has stated that it is aiming for long-term schedule reliability rates of 90%. However, in the short term, the transition may cause disruptions as carriers adjust their schedules and networks. Meanwhile, the Ocean Alliance will remain stable, with a continued commitment to improving schedule reliability during this period of transition for other alliances.

However, these changes also present opportunities for the industry. By entering into strategic partnerships and sharing capacity on key routes, carriers can improve operational efficiency, reduce costs, and offer more competitive services. This increased competition is likely to benefit cargo owners and freight forwarders, providing them with greater flexibility and access to a broader range of shipping options.

A Positive Transformation in Global Shipping

The changes set to take effect in 2025 represent more than just a restructuring of alliances – they signal a broader transformation in the global container shipping industry. Carriers are increasingly focused on leveraging economies of scale, reducing their environmental impact, and enhancing their service offerings to remain competitive in a rapidly changing market.

While the immediate impact of these changes may be challenging, the long-term outlook is one of opportunity. The dissolution of the 2M partnership, the rise of new alliances like Gemini and Premier, and the expansion of MSC’s standalone network will likely foster a more resilient and sustainable shipping industry.